Breaking News: U.S. Ends $800 De Minimis Rule for China & Imposes Sweeping New Tariffs

In a significant shift in trade policy, the White House has announced the elimination of the de minimis tax exemption for Chinese exports valued under $800, effective May 2nd. This adjustment is a component of the newly introduced T86 policy, which aims to close a loophole that previously allowed small-value shipments from China to enter the U.S. without paying duties, a benefit critics claim disproportionately favored Chinese manufacturers.

Under the new guidelines, all Chinese imports, regardless of their value, will now be subject to tariffs. These imports will be processed under a more stringent customs designation, T86, targeting the influx of low-cost e-commerce goods from companies like Shein and Temu that have historically bypassed duties. This policy change seeks to ensure a more equitable trading environment and address concerns over market fairness.

On Wednesday, President Donald Trump announced aggressive new tariffs on nearly all U.S. trading partners, including a 34% tax on imports from China and 20% on the European Union, marking a dramatic escalation in trade policy that could reshape the global economy.

Speaking from the White House Rose Garden, Trump declared these measures were necessary to combat what he called an “economic emergency.” The tariffs, he argued, are designed to revitalize U.S. manufacturing and address trade imbalances, but critics warn they could spark retaliatory trade wars and economic slowdowns as businesses and consumers face higher prices.

The White House claims that trade imbalances cost the U.S. $1.2 trillion last year, justifying the move. However, economists caution that other nations may retaliate, worsening the situation.

What Are Tariffs, Exactly?

Tariffs are duties paid on goods imported into the U.S. The most common type of tariffs are ad valorem tariffs (Latin for “according to the value”), which represent a fixed percentage tax on the value of a product. The 25% auto tariffs are these types of tariffs.

There are also “specific” tariffs, which are levied as a fixed charge per unit, and “tariff-rate quotas,” which are taxes triggered by reaching a specific import threshold.

Why Do Tariffs Exist?

Governments use tariffs for a variety of reasons, often with the goal of:

-

Protecting Domestic Industries: By making imported goods more expensive, tariffs can give locally produced items a competitive edge. This can help safeguard jobs and support national businesses.

-

Generating Government Revenue: Tariffs provide a source of income for the government, similar to other taxes.

-

Influencing Trade Policy: Tariffs can be used as a bargaining chip in international trade negotiations, or as a way to exert pressure on other countries

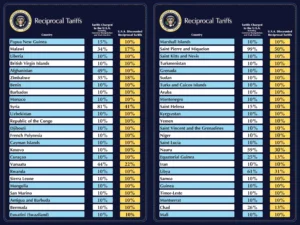

The U.S. “Reciprocal Tariff” List

Trump’s new “reciprocal tariff” system aims to match or in some cases, halve – the rates that other countries impose on U.S. exports. Below is a snapshot of the new rates set to take effect:

|

COUNTRY

|

TARIFF RATE FOR U.S.

|

U.S. RECIPROCAL TARIFF RATE

|

|

CHINA

|

67%

|

34%

|

|

EUROPEAN UNION

|

39%

|

20%

|

|

VIETNAM

|

90%

|

46%

|

|

JAPAN

|

46%

|

24%

|

|

INDIA

|

52%

|

26%

|

|

SOUTH KOREA

|

50%

|

25%

|

|

THAILAND

|

72%

|

36%

|

|

SWITZERLAND

|

61%

|

31%

|

|

INDONESIA

|

64%

|

32%

|

|

MALAYSIA

|

47%

|

24%

|

|

CAMBODIA

|

97%

|

49%

|

|

UK

|

10%

|

10%

|

|

SOUTH AFRICA

|

60%

|

30%

|

|

BRAZIL

|

10%

|

10%

|

|

BANGLADESH

|

74%

|

37%

|

|

SINGAPORE

|

10%

|

10%

|

|

ISRAEL

|

33%

|

17%

|

|

PHILIPPINES

|

34%

|

17%

|

|

CHILE

|

10%

|

10%

|

|

AUSTRALIA

|

10%

|

10%

|

|

PAKISTAN

|

58%

|

29%

|

|

TURKEY

|

10%

|

10%

|

|

SRI LANKA

|

88%

|

44%

|

|

COLOMBIA

|

10%

|

10%

|

While some nations (like the UK and Australia) face only the baseline 10% tariff, others, particularly China, Vietnam, and the EU will see much steeper costs.

Final Thoughts: Navigating the New Trade Landscape

The global supply chain is entering uncharted territory. While the long-term impact of these tariffs remains uncertain, businesses must act now to mitigate risks.

At NextSmartShip, we specialize in helping companies optimize their supply chains, analyze cost impacts, and develop tariff mitigation strategies. Whether you’re reassessing suppliers, exploring alternative markets, or adjusting pricing models, our team is here to support you.

Need help adapting to these changes? We’ve put together a free whitepaper on tariff mitigation strategies and a video breaking down the key differences between U.S. and China warehouses. Contact us today for a consultation.